GSTR 1 Advance Adjustment: All You Need to Know

- 7 Aug 25

- 11 mins

GSTR 1 Advance Adjustment: All You Need to Know

- What Does Advance Payment Mean Under GST?

- GST on Advance Received

- Received Advances in the Supply of Goods

- Treatment of Advance Received in GST

- Application of GST on Advance Payment for Future Supplies

- Rules and Exceptions for GSTR-1 Advance Adjustment

- Reconciliation and GST Adjustment of Advance Payment

- What Should a Taxpayer Do When Receiving Advance GST Payment?

- Reporting of Advances Received in GSTR-1

- Conclusion

Key Takeaways

- Advance payments received for supplies must be reported in GSTR-1, even before goods or services are delivered.

- Suppliers of services must pay GST on advances received, while goods suppliers are exempt unless an invoice is issued.

- Adjustments in GSTR-1 are made through Tables 11A (advances received) and 11B (adjustments against invoices).

- In case of supply cancellation, advance amounts can be refunded or adjusted in future invoices depending on agreements.

- Timely and correct GSTR-1 advance adjustment avoids tax mismatches, ensures compliance, and prevents audit complications.

GSTR-1 advance adjustment is the process of modification of details of advance payments received for the supply of goods under the GST regime during the monthly return of GSTR-1 & 1A. Most of the time, businesses receive advance payment from customers before the supply of goods and services. These advanced payments are taxable and should be reported in GSTR-1.

However, when you issue an invoice or cancel a supply, you should make adjustments accordingly to reflect the taxable amount. Advance adjustment in the GSTR-1 page accurately ensures direct tax compliance with GST laws, prevents mismatch of taxes and maintains financial records while experiencing a seamless filing of returns.

What Does Advance Payment Mean Under GST?

When a customer makes an advance payment to a supplier on procurement of goods and services, the supplier must pay GST on such advance payment as a consideration for supply. The customer makes this advance payment even before the transaction takes place.

This implies that even before the delivery of goods and services takes place, tax authorities consider the advance amount as tax.

GST on Advance Received

In business, it is quite common to receive an advance for the supply of goods and services at a later date. The authorities might subject this kind of advance receipt, commonly known as advanced under GST, to taxation, considering the nature and time of supply.

Received Advances in the Supply of Goods

For the supply of goods, the receiver does not subject the received advance amount to GST. When the supplier actually provides the goods, the entire amount is taxed, considering the time of supply.

In general, the time of supply for goods takes place earliest of the following:

- Date of payment

- Date of issuance of an invoice or the last date on which issuance of invoice to take place

For example, Mrs X entered into a contract with XYZ Ltd. to purchase certain goods and made an advance payment of Rs. 10,000 on 15th May 2023. The goods were delivered to Mrs. X on 1st June 2024 and XYZ Ltd. issued the final invoice for Rs. 30,000 on 25th June 2023.

The remaining balance due on the invoice was paid later on by Mrs X on 14th July 2023. Here, the time of supply will be earlier between two dates, i.e. 25th June 2023 for taxation of the full amount of Rs. 30,000.

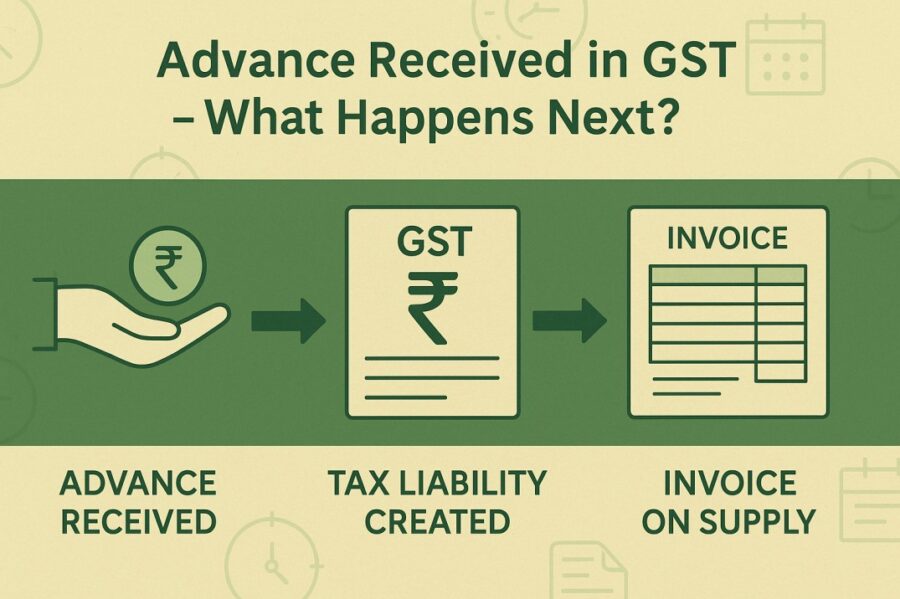

Treatment of Advance Received in GST

Every business must determine the time of supply regulations when tax is due to be paid to the government.

The time of supply usually indicates the earliest among the following dates (applicable for supply for services):

- Date of issuance of the invoice, or,

- Date of receiving the payment or advanced amount, or,

- In case of delay in issuance of an invoice for any underlying reasons, then the last date on which the issuance of an invoice takes place.

If you receive advanced payment for services, then the time of supply will be the date on which you have received the advance amount and not the date of issuance of an invoice for the advanced amount. This, however, does not work well for the supply of goods and applies only to the supply of services.

During issuance of an invoice, the supplier charges a tax amount (that includes taxes on advanced amounts) for the supply of goods.

Application of GST on Advance Payment for Future Supplies

The taxable event under GST takes place during the time of supply. There is no supply scenario during advance payments. Thus, one might keep on wondering about the significance of GST applicability.

The main reason behind GST law applicability is the consideration of advance payment as a consideration for supply. In other words, the government considers advance payment in terms that supply has already taken place for tax-related purposes.

Let’s explore the application of GST on advance payment for future related supplies:

- Determination of Time of Supply

The CGST Act, 2017 covers the current period when a taxpayer needs to discharge GST on any particular supply under Sections 12 to 14. The 'time of supply' denotes the time when a supplier receives payment for that supply.

This also considers other factors such as the issuance of receipt of goods and others. Usually, the time of supply denotes the initial period of issuance of an invoice or payment receipt.

- Deemed Supply

According to Section 12 of the CGST Act 2017, an invoice or payment covers a "supply". For instance, if you receive an advance payment of Rs. 5 lakh for a supply worth Rs. 1 crore in the future, the time of supply applicable for the advanced amount is during the time of advance tax receipt.

- Advance Payments

Under cases of advance received for any supply, the time of supply is when an advance is received. This is applicable irrespective of whether the actual mode of supply is met or not.

However, GST should be paid during the time when advance payment is received. This needs compliance with several procedures, tax reconciliation and documentation of taxes paid in advance.

- Supply Cancellation

If there is cancellation of supply after payment of advance amount, then the received amount might be refunded or adjusted for later supplies, considering the agreements. Each of these scenarios undergo different tax treatments.

- Exemptions for Goods Suppliers

The government after recognising the compliance burden for small businessmen regarding GST on advances, underwent issuance of Notification No. 66/2017 dated 15.11.2017. This notification exempts all suppliers of goods and services, who have not chosen the composition scheme, from the burden of GST payment on the received advance amount.

Particularly, for these specific categories of taxpayers, the time of supply arises during the issuance of an invoice.

- Supplier of Services

It is mandatory, however, for suppliers of services to make GST payments during receipt of advance.

Rules and Exceptions for GSTR-1 Advance Adjustment

With the application of GST on advance payments, there are certain specific rules and exceptions for advance payments:

- Zero GST Rate: If a zero GST rate applies to advance transactions, businesses might not be able to match and offset receipts against invoices. This means that if taxes on goods and services are subject to a zero rate, businesses do not need to pay GST in advance.

- Interstate and Intrastate Transactions: Calculating different components of GST is important, considering whether the transaction is made interstate or intrastate. For interstate advances, you need to calculate Integrated GST (IGST) while for intrastate transactions, you need to calculate the State GST (SGST) and Central GST (CGST).

Reconciliation and GST Adjustment of Advance Payment

Continue exploring the steps below for processing advance payment and making adjustments in GST applicable for goods and services in the GST regime.

Creating Unapplied Receipts

Consider a designated program for creating unapplied receipts for making advance payments. These receipts are usually created with a mismatch of invoices as there is an absence of actual supply.

Calculation of GST for Making Advance Payments

Separate programs enrol for the calculation of GST relating to advance payments for goods and services. These programs take into consideration factors such as the Harmonized System of Nomenclature (HSN) and Service Accounting Code (SAC) tax rates.

Match and Offset Receipts

For offsetting advance payments against invoices, consider using specific programs separately for goods and services. This step ensures accurate adjustments in GST liabilities.

What Should a Taxpayer Do When Receiving Advance GST Payment?

Once receiving the receipt of advance on GST payment, a taxpayer should consider the following actions:

Issuance of a Receipt Voucher

It is essential for a supplier to issue a receipt voucher to an individual, making advance payment. The receipt voucher entails details of the advance sum amount, description of goods and services, applicable rates of taxes, etc.

Calculate GST on the Received Advanced Amount

Next, the supplier should calculate the GST amount on the received advance amount and pay taxes while filing tax returns for the month. Make sure to consider an average of the received advance amount. This indicates that the advance received includes GST.

When it will be impossible to determine the rate of taxes during advanced receipt of payment, then a GST of 18% is applicable. Also, if the place of supply cannot be determined, the received advance is an interstate supply and IGST must be paid.

Make sure to note here that taxpayers paying advance taxes don’t qualify for claiming input tax credit (ITC) on the advanced amount. The primary rule for claiming ITC under GST requires that the taxpayer has received all essential goods and services.

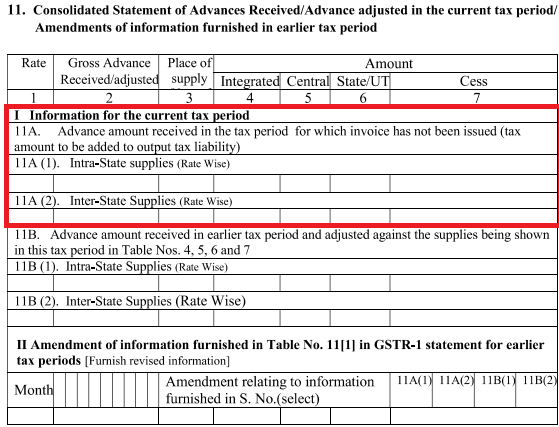

Reporting of Advances Received in GSTR-1

Any advance amount a taxpayer has not received for which the original invoices have not been issued is mandatory to be mentioned under Table 11A of the GSTR-1 return page. It is, however, not necessary to provide detailed information about each advance; a cumulative figure of all advance amounts will be adequate.

On the other hand, Table 11B requires taxpayers to make necessary adjustments in advanced amounts in the previous tax period against the issue of invoice during the current tax period.

Divide the advanced amount into both interstate and intrastate advances. Alongside, mention an approximate figure of the advance amount you receive under 'Gross Advance Received'. After this, make sure to state the taxes paid i.e. SGST and CGST applicable for intrastate and IGST under interstate. This GST amount on advances should be added to the total tax liabilities of the suppliers involved.

Conclusion

To summarise, when businesses file GSTR-1 accurately reporting advance payments, it ensures real-time reflection of supplies, prevents double taxation, minimises errors and maintains consistency with GSTR-3B data.

Failing to make necessary adjustments might lead to compliance issues and tax liabilities. By gaining a thorough understanding of the process and providing regular updates on their return filing, it is possible for taxpayers to report tax liabilities and minimise the chances of penalties and audits.

Overall, on-time GSTR-1 & GSTR advance adjustment is crucial for maintaining transparency and efficient GST compliance.

💡If you want to streamline your payment and make GST payments via credit card, consider using the PICE App. Explore the PICE App today and take your business to new heights.